You're now following

Error following user.

This user does not allow users to follow them.

You are already following this user.

Your membership plan only allows 0 follows. Upgrade here.

Successfully unfollowed

Error unfollowing user.

You have successfully recommended

Error recommending user.

Something went wrong. Please refresh the page and try again.

Email successfully verified.

kraków, poland

It's currently 8:50 AM here

Joined September 2, 2014

1 Recommendation

Alexander P.

@apoplavsky

7.0

7.0

93%

93%

kraków, poland

100%

Jobs Completed

100%

On Budget

100%

On Time

25%

Repeat Hire Rate

Lead AI / Data Science Engineer, Startup Founder

Contact Alexander P. about your job

Log in to discuss any details over chat.

Portfolio

Portfolio

Online financial calculators

Online financial calculators

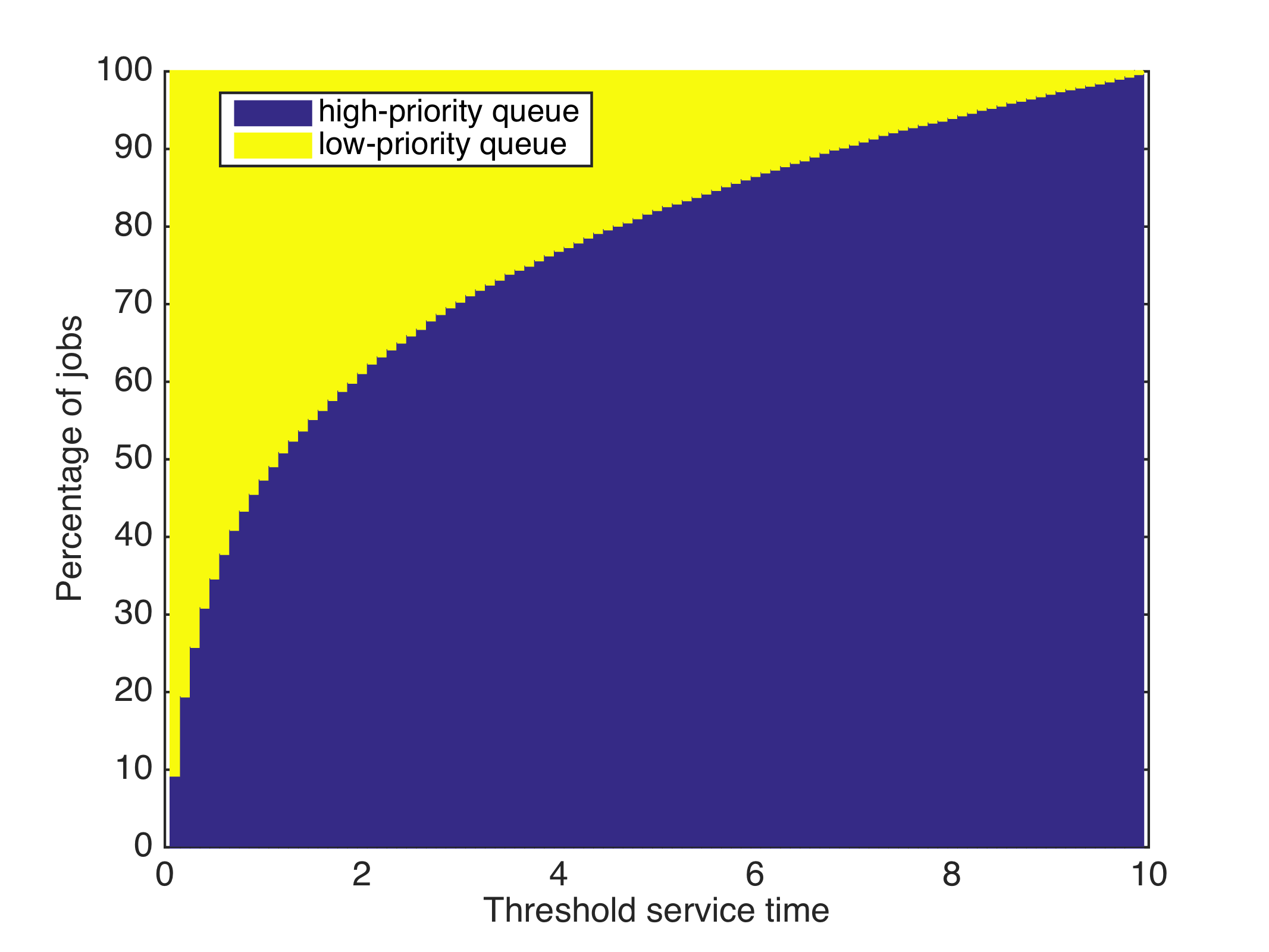

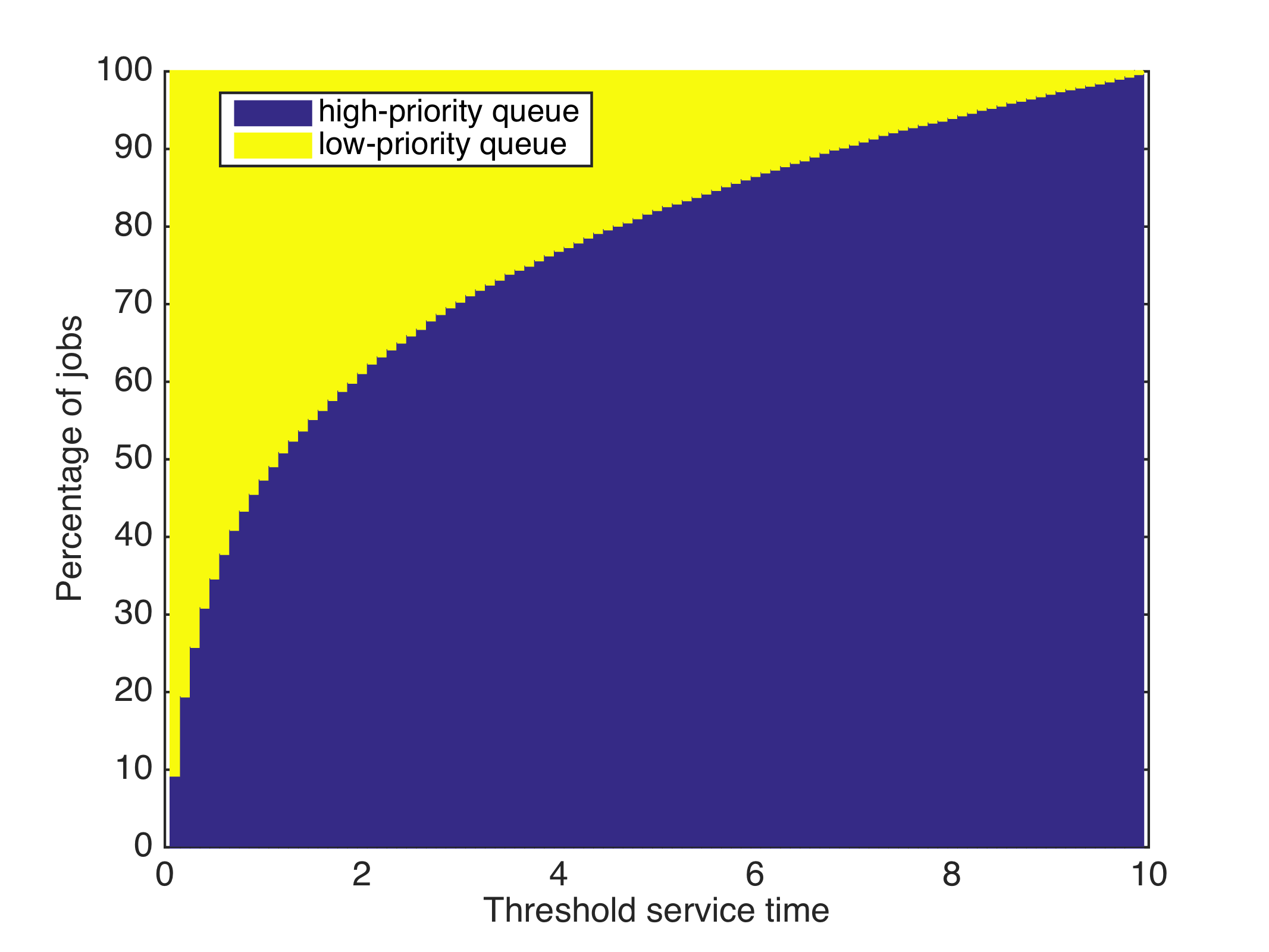

Priority Queue Simulation

Priority Queue Simulation

Priority Queue Simulation

Priority Queue Simulation

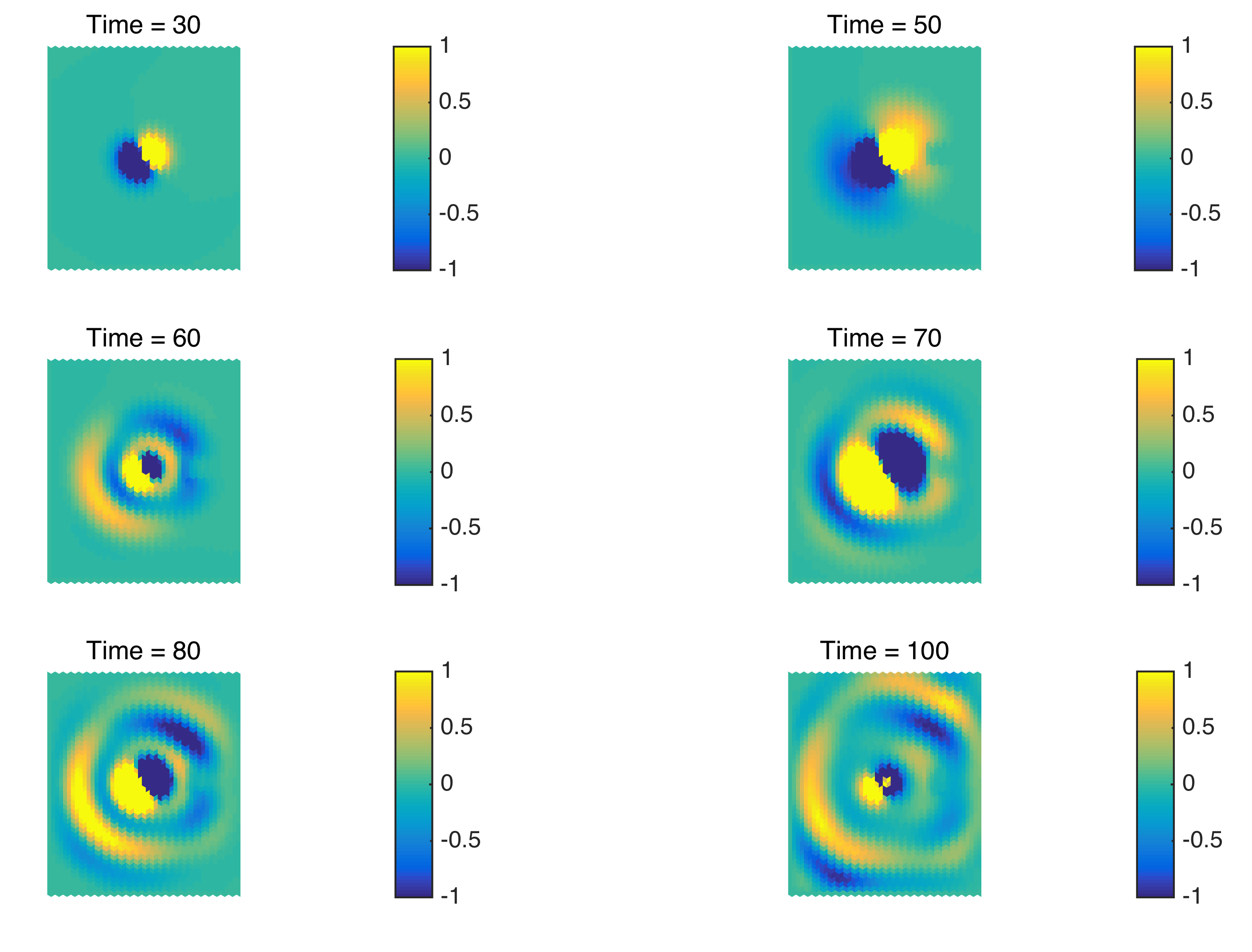

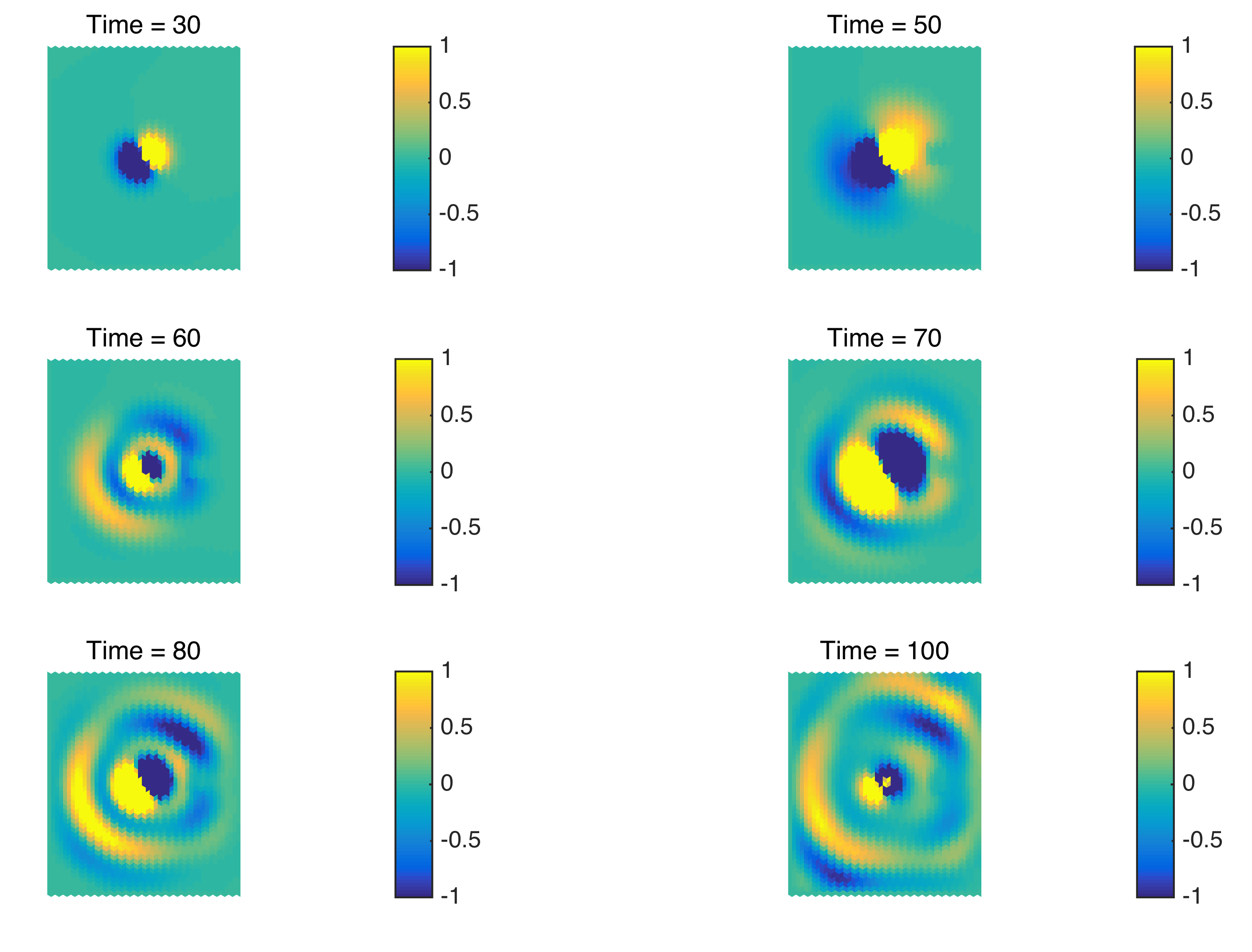

Electromagnetic wave propagation on the hexagonal grid

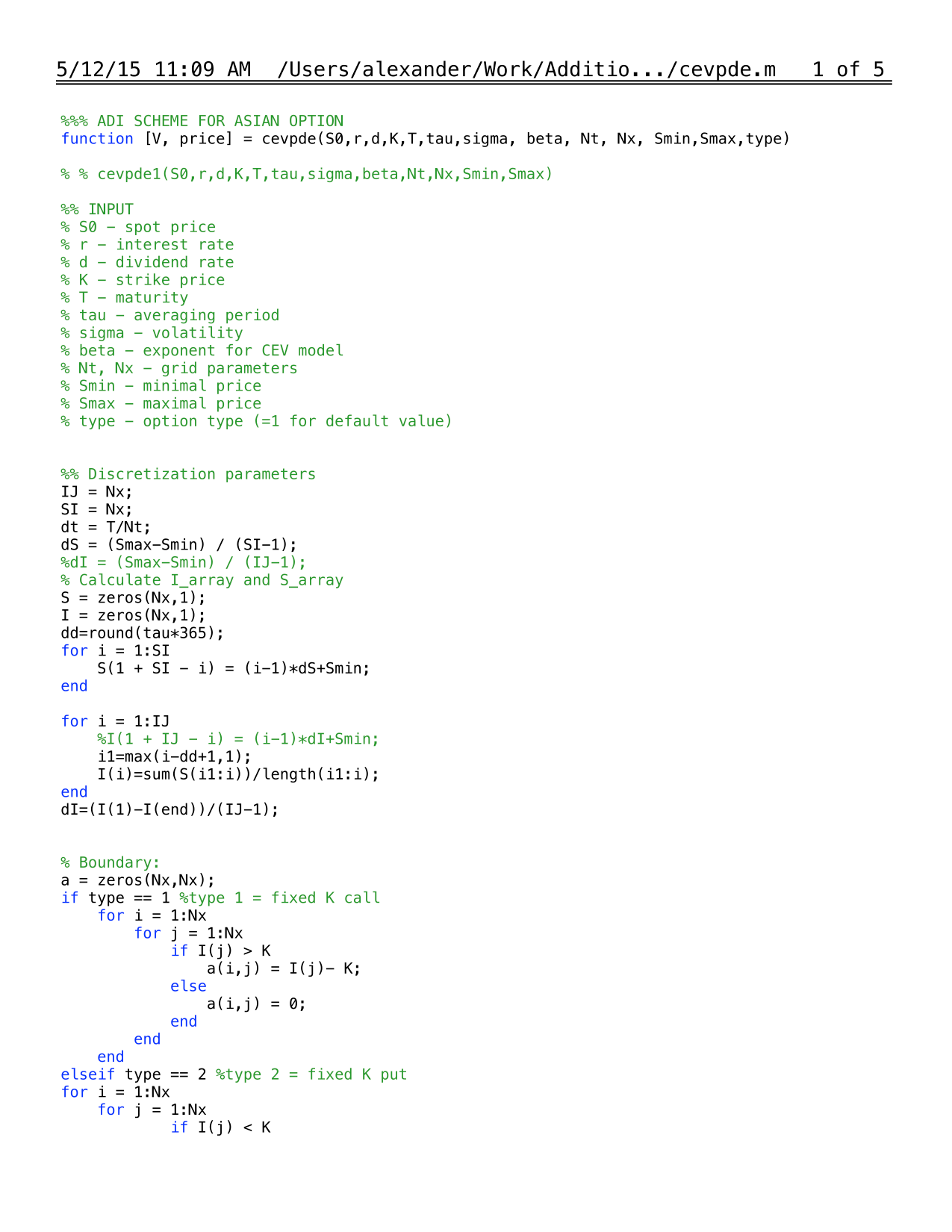

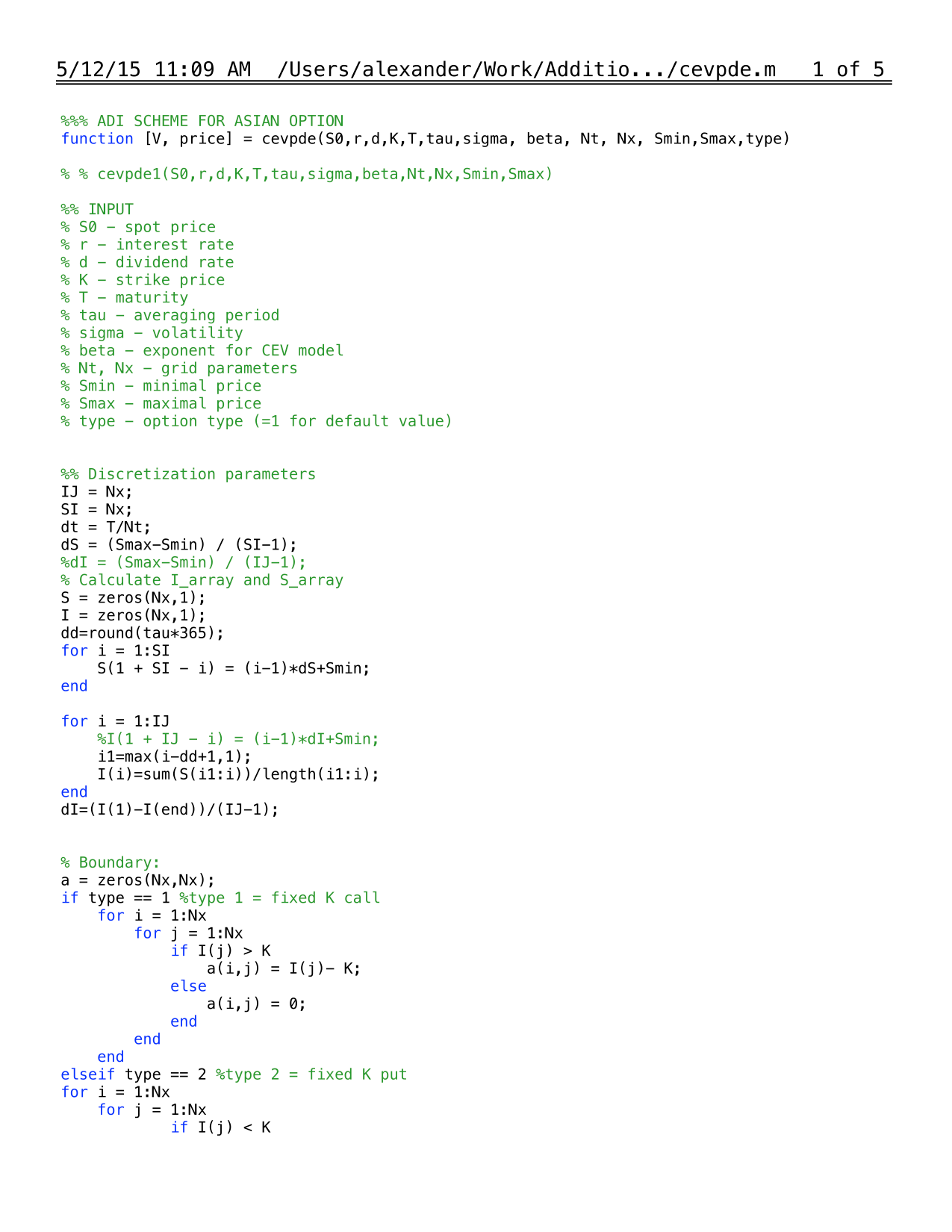

Asian Option Pricing

Asian Option Pricing

Asian Option Pricing

Asian Option Pricing

Asian Option Pricing

Black-Scholes Equation

Black-Scholes Equation

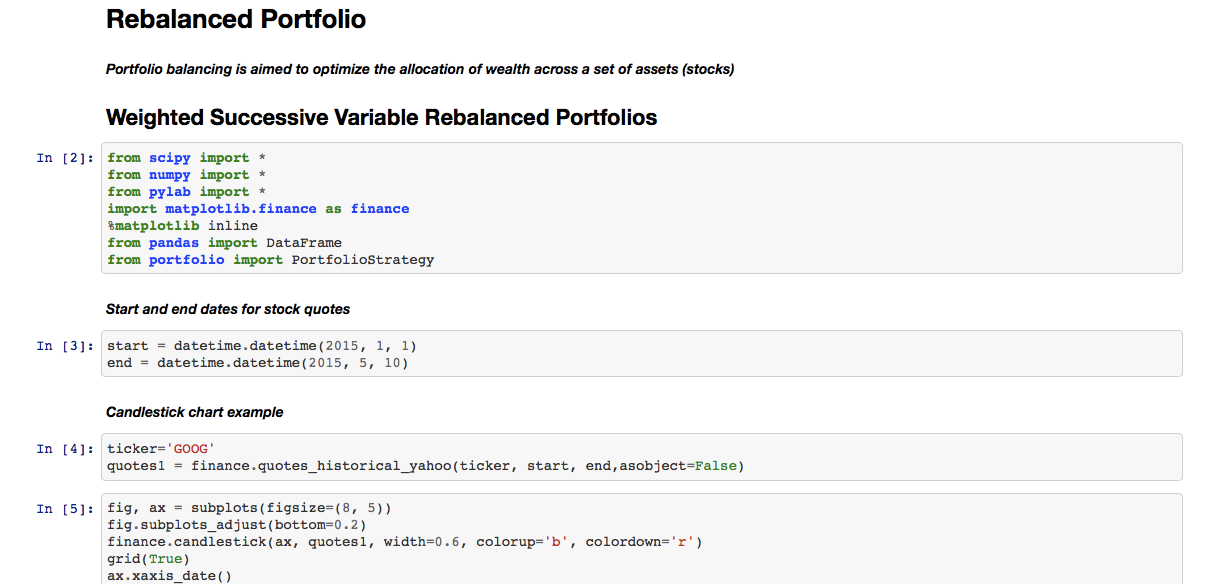

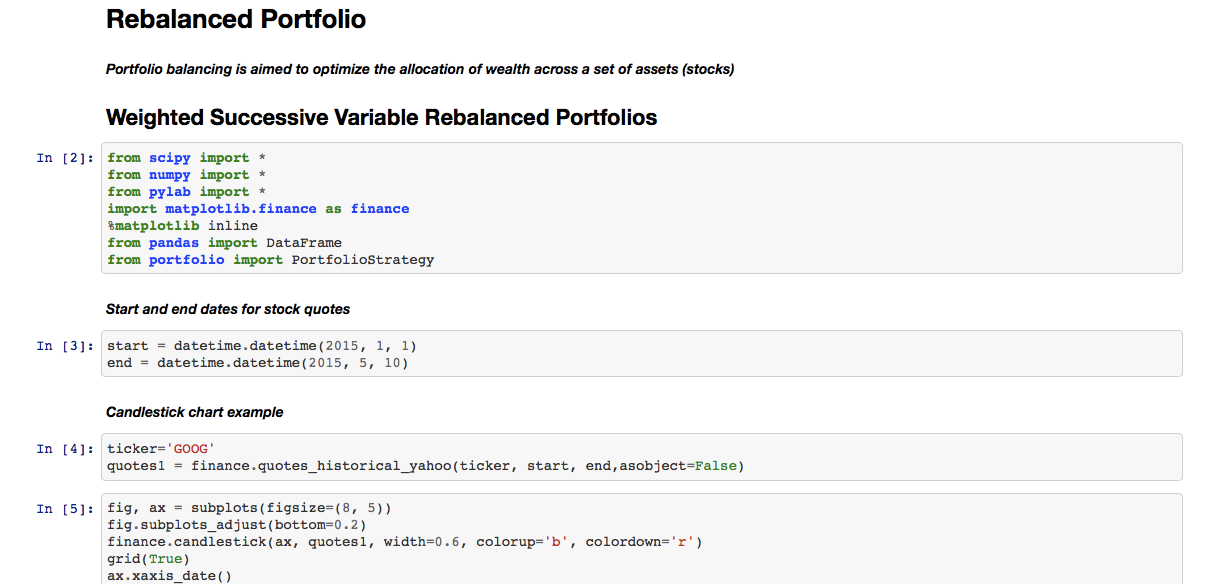

Rebalanced Portfolio

Rebalanced Portfolio

Rebalanced Portfolio

Rebalanced Portfolio

Rebalanced Portfolio

Rebalanced Portfolio

Rebalanced Portfolio

Online financial calculators

Online financial calculators

Priority Queue Simulation

Priority Queue Simulation

Priority Queue Simulation

Priority Queue Simulation

Electromagnetic wave propagation on the hexagonal grid

Asian Option Pricing

Asian Option Pricing

Asian Option Pricing

Asian Option Pricing

Asian Option Pricing

Black-Scholes Equation

Black-Scholes Equation

Rebalanced Portfolio

Rebalanced Portfolio

Rebalanced Portfolio

Rebalanced Portfolio

Rebalanced Portfolio

Rebalanced Portfolio

Rebalanced Portfolio

Reviews

Changes saved

Showing 1 - 5 out of 14 reviews

€19,185.00 EUR

Python

Algorithm

Statistics

Mathematics

+1 more

•

$5,100.00 USD

Matlab and Mathematica

Algorithm

Mathematics

Financial Analysis

•

$21.00 USD

Python

Machine Learning (ML)

Programming

Neural Networks

Tensorflow

P

•

€550.00 EUR

Software Architecture

Finance

Software Development

A

•

₹27,600.00 INR

Python

Statistics

Q

•

Contact Alexander P. about your job

Log in to discuss any details over chat.

Verifications

Top Skills

Browse Similar Freelancers

Browse Similar Showcases

Invite sent successfully!

Thanks! We’ve emailed you a link to claim your free credit.

Something went wrong while sending your email. Please try again.

Loading preview

Permission granted for Geolocation.

Your login session has expired and you have been logged out. Please log in again.